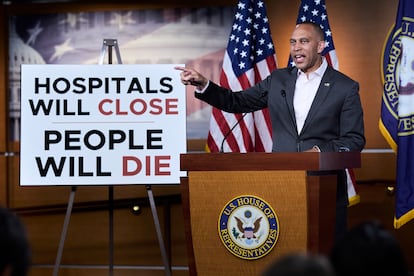

Trump's Tax Cuts Could Cost Millions Their Health Insurance: CBO Report

A new report from the Congressional Budget Office (CBO) paints a stark picture: President Trump's 2017 tax cuts, while touted as a boon for the economy, could leave as many as 10.9 million Americans without health insurance. The report, released amidst ongoing debate about healthcare access, highlights the unintended consequences of the tax law and its impact on the nation's social safety net.

The CBO’s analysis reveals a complex interplay between tax policy and healthcare coverage. The core of the issue lies in the repeal of the individual mandate penalty under the Affordable Care Act (ACA). This penalty, previously required for those who didn't have health insurance, incentivized many to enroll in plans. Without it, the CBO predicts a significant drop in insurance coverage.

The Numbers: A Concerning Trend

The report estimates that by 2029, 10.9 million more people will be uninsured compared to what would have occurred if the individual mandate had remained in place. This isn't just a statistical figure; it represents millions of individuals and families facing potential financial ruin in the event of a medical emergency.

Furthermore, the CBO projects that the tax cuts will add a staggering $2.4 trillion to the national deficit over the next decade. This financial burden raises questions about the long-term sustainability of government programs and the potential for future cuts to essential services, including healthcare.

Elon Musk's Critique: A 'Disgusting Abomination'

The tax law hasn't been without its critics. Even tech mogul Elon Musk has publicly denounced it, calling it a “disgusting abomination.” Musk’s strong stance reflects a growing sentiment among some that the tax cuts disproportionately benefit the wealthy while leaving many Americans struggling.

The Impact on Healthcare System

The potential loss of coverage has far-reaching implications for the healthcare system. Hospitals and healthcare providers could face increased uncompensated care costs, leading to higher prices for those who remain insured. It could also strain the safety net, as more uninsured individuals turn to emergency rooms for care, which is the most expensive form of healthcare delivery.

Political Fallout and Future Prospects

The CBO report is likely to fuel further political debate over healthcare policy. Democrats are expected to use the findings to argue for strengthening the ACA and expanding access to affordable health insurance. Republicans, on the other hand, may emphasize the potential economic benefits of the tax cuts and argue for alternative approaches to healthcare reform.

The report serves as a crucial reminder that policy decisions have complex and often unforeseen consequences. As the nation grapples with the challenges of healthcare affordability and access, this analysis underscores the need for careful consideration of the potential impact on millions of Americans.

While the long-term effects remain to be seen, one thing is clear: the debate over healthcare and tax policy is far from over, and the stakes are incredibly high.