Haircut Victims Demand Face-to-Face Meeting with Finance Minister Over Compensation

Cyprus Haircut Victims Seek Urgent Talks with Finance Minister

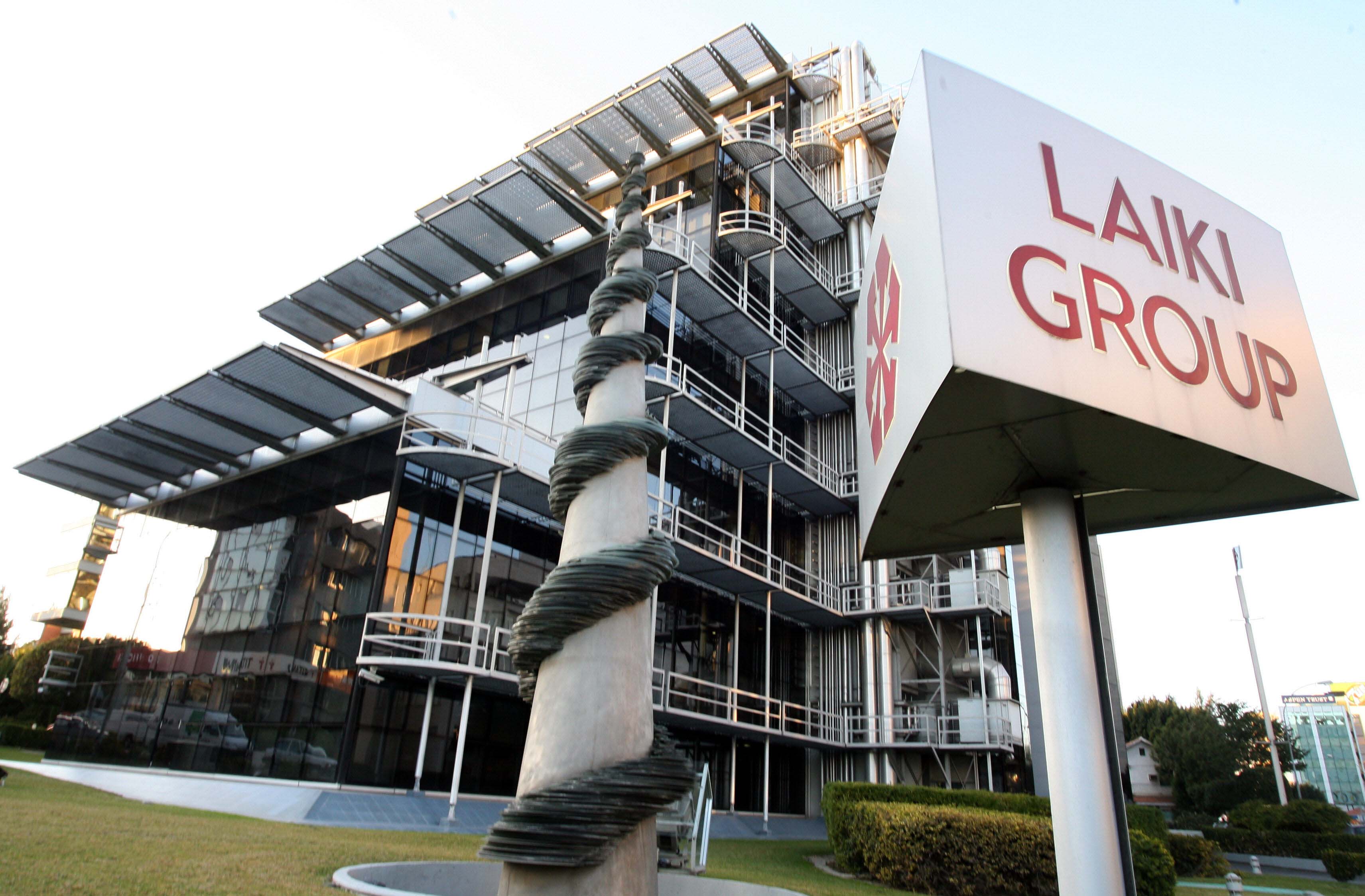

Depositors and bondholders who suffered devastating losses during the 2013 Cypriot bank bail-in are intensifying their campaign for fair compensation. A group representing these victims issued a stern statement on Tuesday, expressing deep frustration with the current compensation scheme and demanding an in-person meeting with the Finance Minister before the end of the week.

The 2013 bail-in, a drastic measure implemented to prevent a complete collapse of the Cypriot financial system, resulted in a significant 'haircut' – a direct reduction – of deposits exceeding €100,000. This unprecedented action wiped out a substantial portion of savings for many individuals and businesses, sparking widespread anger and financial hardship.

While a compensation scheme was subsequently established, victims argue that the terms are inadequate and fail to fully address the losses incurred. They contend that the scheme's calculations are flawed, the appeals process is cumbersome, and the overall level of compensation is far below what is justified given the circumstances. Many feel they were unfairly penalized for a crisis not of their making.

“We have been patient, we have followed the legal channels, but our concerns have not been adequately addressed,” stated a spokesperson for the victims’ group. “We need to sit down with the Finance Minister and have a frank discussion about the injustices we have suffered and what can be done to rectify the situation. A written response is simply not enough; we require a direct dialogue to ensure our voices are heard.”

The victims are seeking a comprehensive review of the compensation scheme, including a reassessment of the calculation methodology, a streamlined appeals process, and a significant increase in the level of compensation offered. They are also calling for greater transparency in the government’s handling of the bail-in and its aftermath.

The Finance Ministry has yet to officially respond to the victims’ request for a meeting, but sources indicate that discussions are underway to determine the feasibility of accommodating the request. The outcome of this meeting could have significant implications for the ongoing dispute and the future of compensation for those affected by the 2013 bank bail-in.

This situation highlights the long-lasting repercussions of the 2013 financial crisis in Cyprus and the ongoing struggle for justice faced by those who lost their savings. The demand for a meeting with the Finance Minister signals a renewed determination to seek redress and ensure that the lessons of the past are not forgotten.