Amkor Technology (AMKR): Navigating Choppy Waters – Is Now the Time to Hold?

Amkor Technology (AMKR) has shown remarkable resilience, bouncing back from a significant downturn. However, the semiconductor landscape remains complex, with persistent headwinds and fluctuating demand creating an air of uncertainty. Investors are left wondering: can Amkor maintain its upward trajectory, or are we poised for another dip? This analysis delves into Amkor's current position, explores the challenges it faces, and ultimately provides a reasoned perspective on whether AMKR stock warrants a 'hold' rating.

A Recent Rebound – But Why the Caution?

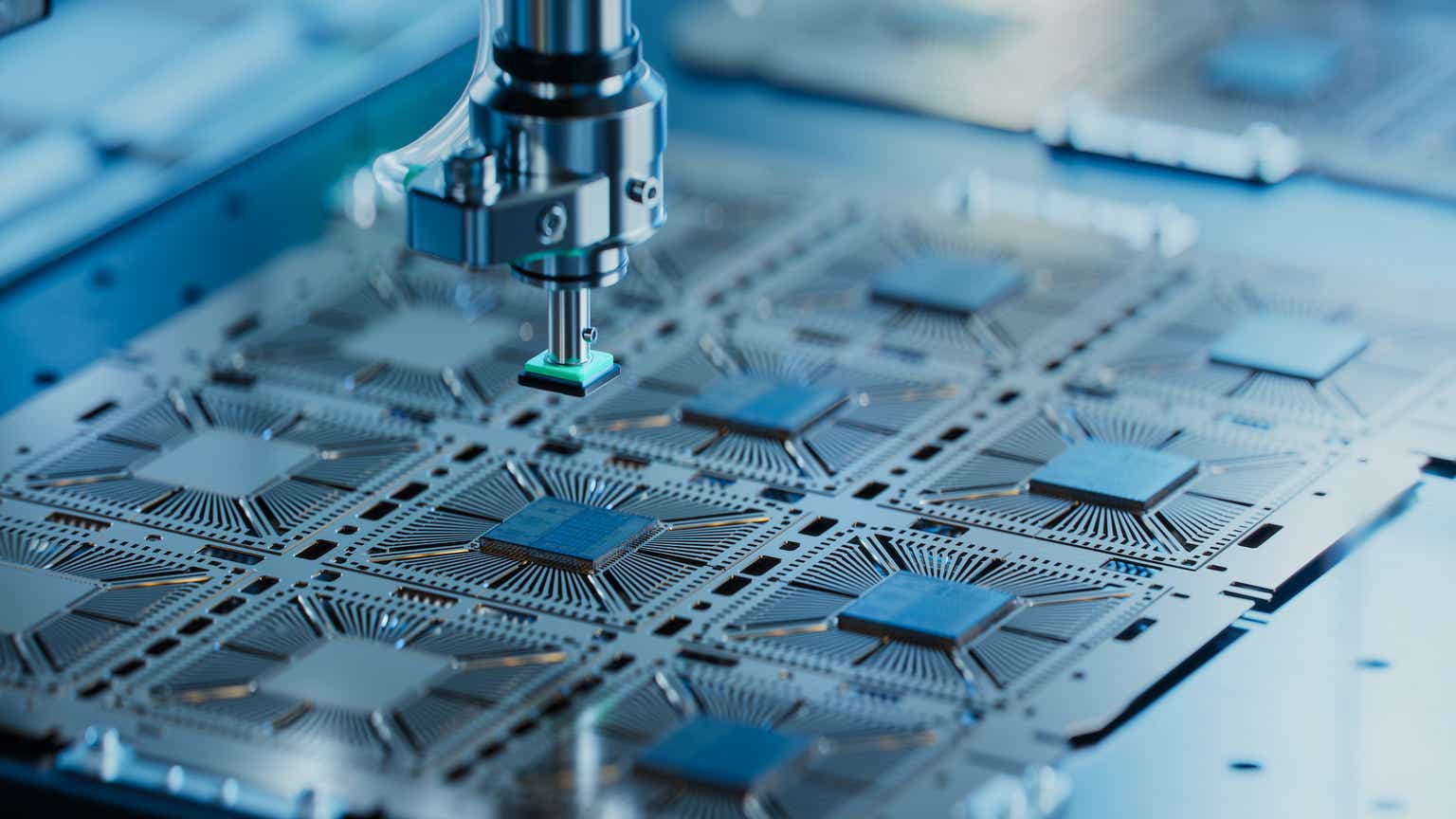

The past year has been a rollercoaster for Amkor. Like many players in the semiconductor industry, the company experienced a sharp decline as demand softened following the pandemic-fueled boom. However, Amkor's strategic focus on advanced packaging – a critical component in modern semiconductors – has helped it weather the storm better than some of its peers. The recent rebound is a testament to this focus and the company's ability to adapt.

Headwinds Remain: A Look at the Challenges

Despite the positive momentum, several significant headwinds continue to buffet Amkor. Firstly, the overall macroeconomic environment remains uncertain. Rising interest rates and persistent inflation are dampening consumer spending, which in turn impacts demand for electronics – and consequently, semiconductors.

Secondly, the semiconductor industry is notoriously cyclical. While the current cycle may be stabilizing, predicting the timing and magnitude of the next downturn is notoriously difficult. Geopolitical tensions, particularly surrounding Taiwan (a crucial hub for semiconductor manufacturing), add another layer of complexity and risk.

Finally, competition within the advanced packaging market is intensifying. While Amkor holds a strong position, it faces pressure from both established players and emerging competitors.

Demand Trends: A Mixed Bag

Demand for semiconductors is not uniform across all segments. While demand for certain types of chips, such as those used in artificial intelligence and high-performance computing, remains robust, demand for others, particularly in consumer electronics, remains subdued. Amkor's ability to diversify its customer base and adapt to shifting demand patterns will be crucial to its long-term success.

Why 'Hold' Might Be the Right Strategy

Despite the challenges, there are compelling reasons to maintain a 'hold' rating on AMKR stock. Amkor's focus on advanced packaging positions it well to benefit from the long-term growth trends in the semiconductor industry. Advanced packaging is becoming increasingly important as chip designs become more complex and require greater integration.

Furthermore, Amkor's strong customer relationships and its track record of operational excellence provide a degree of stability in a volatile market. The recent rebound suggests that the worst of the downturn may be over, and the company is well-positioned to capitalize on future opportunities.

Looking Ahead: Key Factors to Watch

- Macroeconomic Conditions: Monitor inflation, interest rates, and overall economic growth.

- Semiconductor Cycle: Track industry trends and anticipate potential shifts in demand.

- Geopolitical Risks: Stay informed about developments related to Taiwan and other key regions.

- Competitive Landscape: Assess Amkor's ability to maintain its market share in the face of increasing competition.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Investors should conduct their own due diligence before making any investment decisions.