ASE Technology: Riding the AI Wave - A Top Pick for Semiconductor Packaging Growth in Singapore

Singapore's ASE Technology: Your Smart Investment in the AI Revolution

In the rapidly evolving world of artificial intelligence (AI), the demand for sophisticated semiconductors is soaring. But it's not just about the chips themselves; it's about how they're packaged and tested. This is where ASE Technology (TPE: 2312) comes in, and why I'm recommending a 'Buy' rating for this strategically positioned company.

The Crucial Role of Advanced Packaging

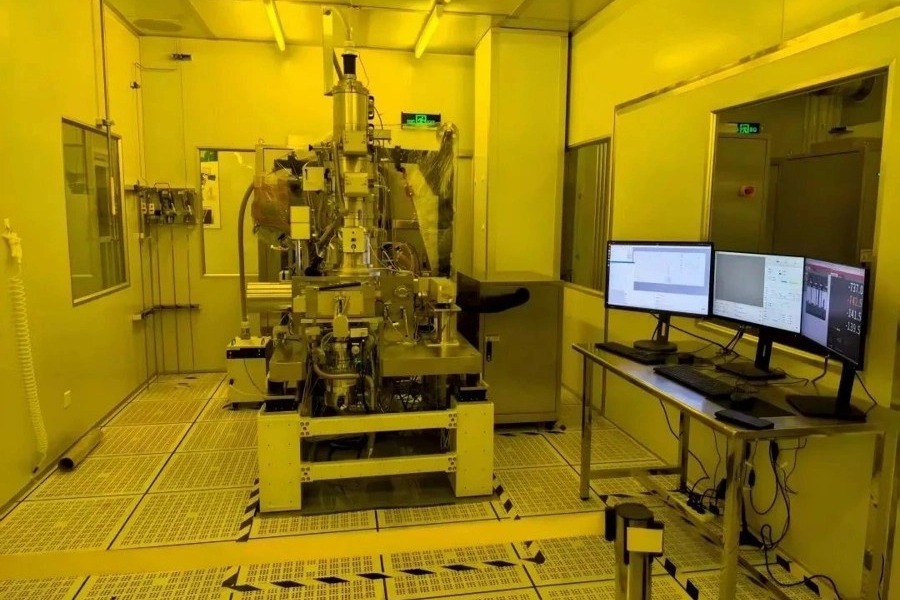

ASE Technology isn't a household name, but it's a vital link in the AI value chain. They specialize in advanced semiconductor packaging and testing – a process that's becoming increasingly complex and critical. As AI models grow larger and more demanding, so too does the need for advanced packaging solutions that can handle the heat, power, and data transfer requirements. Think of it as building a superhighway for data within the chip itself.

Why Advanced Packaging Matters for AI

Traditional chip packaging is no longer sufficient. Modern AI applications, from self-driving cars to cloud computing, require chips that are incredibly powerful and efficient. Advanced packaging techniques like 2.5D and 3D integration allow chipmakers to stack multiple chips vertically, significantly increasing performance and reducing size. ASE Technology is at the forefront of this innovation, offering a range of advanced packaging services that are essential for enabling the next generation of AI hardware.

ASE's Competitive Advantages

Several factors make ASE Technology a compelling investment:

- Market Leadership: ASE is a global leader in semiconductor packaging and testing, with a proven track record of innovation and reliability.

- Strong Customer Relationships: They work with many of the world's leading chipmakers, including those developing AI chips.

- Technological Expertise: ASE's expertise in advanced packaging techniques gives them a significant competitive advantage.

- Strategic Location: Their presence in Singapore, a key hub for technology and manufacturing in Southeast Asia, provides access to a skilled workforce and a supportive business environment. This allows them to serve the growing Asia-Pacific market effectively.

- Exposure to AI Growth: As AI adoption continues to accelerate, demand for ASE’s services will only increase.

Investment Rationale: A 'Buy' Recommendation

The semiconductor industry is cyclical, but the long-term growth drivers for advanced packaging are undeniable, particularly those fueled by AI. ASE Technology is well-positioned to capitalize on this trend. The company's strong market position, technological expertise, and strategic location make it an attractive investment opportunity. While there are risks associated with any investment, I believe the potential upside outweighs the downside.

Looking Ahead

Keep an eye on ASE's investments in new packaging technologies and their ability to secure contracts with leading chipmakers. The company's performance will be a key indicator of the overall health of the AI hardware market. For Singapore investors, ASE offers a unique opportunity to participate in the global AI revolution through a leading local company.