Seagate (STX): Is This Data Storage Giant a Seriously Undervalued Opportunity?

In the ever-expanding world of data, few companies are as crucial as Seagate Technology Holdings (STX). As the demand for data storage skyrockets, fuelled by cloud computing, AI, and the Internet of Things, Seagate sits squarely in the sweet spot. But beyond the favourable macro trends, there's a compelling case to be made that Seagate is currently undervalued, presenting a potentially rare 'too good to be true' opportunity for savvy investors.

Let's unpack why. Firstly, Seagate boasts an incredibly attractive Price-to-Earnings Growth (PEG) ratio. A PEG ratio below 1 is generally considered attractive, suggesting a stock is undervalued relative to its earnings growth. Seagate's current PEG ratio is well below this threshold, indicating significant potential for price appreciation.

Secondly, growth prospects remain robust. The sheer volume of data being generated globally is staggering, and this trend is only accelerating. Seagate is well-positioned to capitalise on this growth, with its products powering everything from enterprise data centres to consumer devices. The company isn't just riding the wave; it's actively shaping it with its innovative technologies.

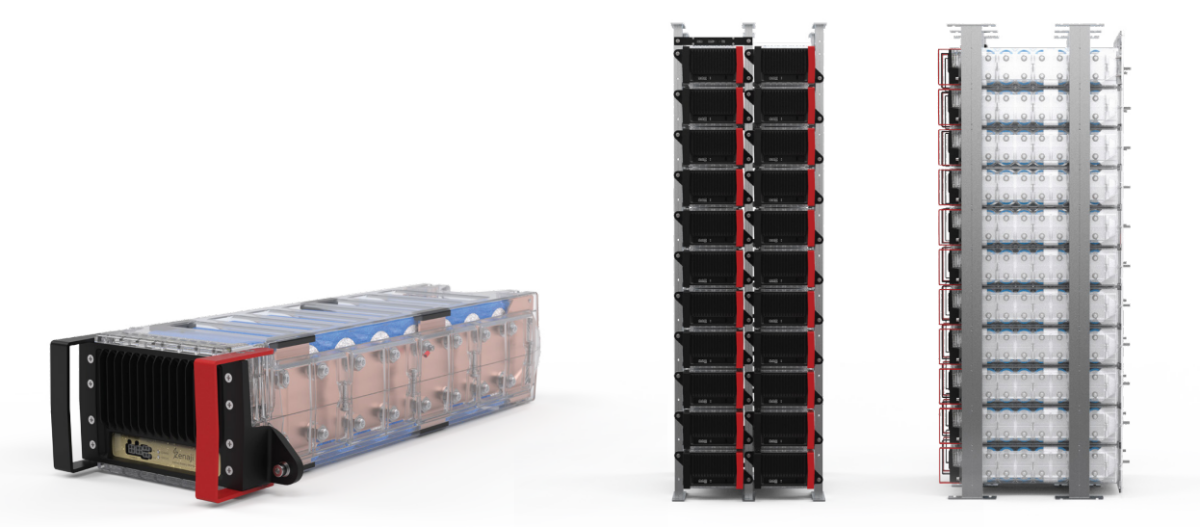

And that brings us to the third key factor: HAMR (Heat-Assisted Magnetic Recording) technology. This groundbreaking innovation allows Seagate to dramatically increase storage density, essentially packing more data into the same physical space. HAMR is a game-changer, enabling Seagate to meet the evolving demands of the data storage market and maintain its competitive edge. The rollout of HAMR is expected to further drive growth and profitability.

Why Seagate Stands Out in a Competitive Landscape

While the data storage market is competitive, Seagate possesses several advantages. Their scale and established relationships with key customers provide a significant barrier to entry for smaller players. They also have a long history of innovation, consistently pushing the boundaries of storage technology. Furthermore, the current market sentiment towards cyclical stocks has unfairly penalized Seagate, creating an opportunity for long-term investors.

Potential Risks and Considerations

Of course, no investment is without risk. Seagate's performance is tied to the overall health of the global economy and the demand for data storage. Fluctuations in hard drive prices and increased competition from solid-state drives (SSDs) are also factors to consider. However, Seagate is proactively addressing these challenges through its HAMR technology and diversification into other storage solutions.

The Verdict: A Strong Buy?

Considering the compelling combination of a low PEG ratio, strong growth potential driven by the surging data market, and innovative technology like HAMR, Seagate (STX) appears to be a compelling investment opportunity. While risks exist, the potential upside appears to outweigh the downsides, making STX a strong buy for investors seeking exposure to the long-term growth of the data storage market. It’s a company that shouldn’t be overlooked – it might just be the 'too good to be true' opportunity you've been searching for.