Amkor Technology (AMKR): Navigating Uncertainty - Is Now a Good Time to Hold?

Amkor Technology (AMKR) has shown impressive resilience, bouncing back from a significant dip in recent months. However, the semiconductor industry remains a complex landscape, facing persistent headwinds and fluctuating demand. Investors are understandably asking: can Amkor maintain its upward trajectory, or are we poised for another correction? This analysis dives deep into Amkor's current position, the challenges it faces, and whether holding AMKR stock remains a prudent strategy.

The Rebound: A Look at Amkor's Recent Performance

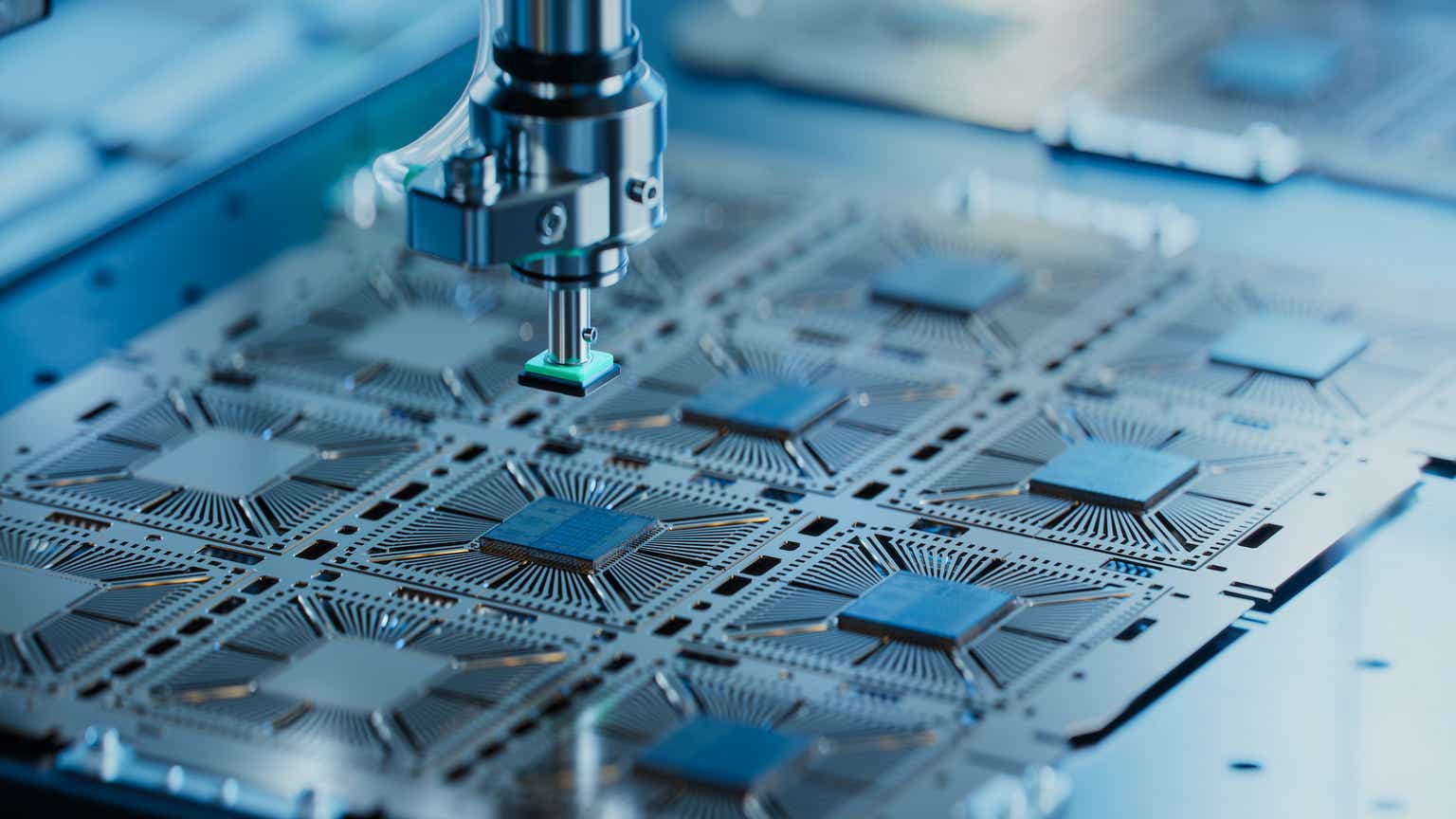

The past year has been a rollercoaster for Amkor Technology. Like many companies in the semiconductor sector, AMKR experienced a sharp decline as demand cooled off following the pandemic-driven boom. However, Amkor’s ability to adapt and manage costs has allowed it to stage a noteworthy recovery. This rebound is largely attributed to its strategic focus on advanced packaging technologies, which are increasingly vital for modern chip designs.

Headwinds Remain: Navigating a Challenging Market

Despite the positive momentum, Amkor isn't immune to the broader economic pressures. Several key headwinds are impacting the semiconductor industry:

- Geopolitical Uncertainty: Ongoing tensions between major economies continue to create supply chain disruptions and impact global demand.

- Macroeconomic Concerns: Rising interest rates and the threat of recession are dampening consumer spending and business investment, which directly affects demand for electronics.

- Inventory Correction: The industry is still working through excess inventory built up during the peak of the pandemic, leading to temporary softening in orders.

- AI Chip Demand - A Double-Edged Sword: While the surge in demand for AI chips is a significant opportunity, it also concentrates demand on specific types of packaging and puts pressure on suppliers.

Amkor's Strengths and Strategic Positioning

Amkor's position isn't all doom and gloom. The company possesses several key strengths that position it well for the long term:

- Advanced Packaging Expertise: Amkor is a leading provider of advanced packaging solutions, a critical area for chip manufacturers looking to improve performance and reduce costs.

- Diverse Customer Base: Amkor serves a broad range of clients, reducing its reliance on any single customer or market segment.

- Global Manufacturing Footprint: A geographically diverse manufacturing network helps mitigate supply chain risks and allows Amkor to serve customers worldwide.

- Focus on Cost Management: Amkor has demonstrated a commitment to controlling costs, which is essential in a cyclical industry.

The Verdict: Hold or Sell?

The question of whether to hold AMKR stock hinges on your risk tolerance and investment horizon. While the short-term outlook remains uncertain due to macroeconomic factors and inventory adjustments, Amkor's strengths and long-term growth potential are undeniable. The advanced packaging market is expected to continue expanding, and Amkor is well-positioned to capitalize on this trend.

For long-term investors with a high-risk tolerance, holding AMKR appears reasonable. However, investors with a shorter time horizon or lower risk tolerance might consider reducing their exposure until the market stabilizes and demand trends become clearer. Careful monitoring of Amkor's earnings reports and industry developments is crucial.

Disclaimer:

This analysis is for informational purposes only and should not be considered financial advice. Investing in the stock market carries inherent risks, and you should consult with a qualified financial advisor before making any investment decisions.