Align Technology: Strong Earnings, But Is the Price Right for ALGN Shares?

Align Technology (ALGN) is a name synonymous with digital orthodontics, dominating the clear aligner market with its Invisalign brand. However, recent earnings reports and market conditions have sparked debate: are the company's fundamentals still strong, and is the current valuation justified? This analysis delves into Align Technology's latest performance, explores the competitive landscape, and assesses whether ALGN stock represents a worthwhile investment for Australian investors.

Solid Earnings, Persistent Challenges

Align Technology recently reported earnings that largely reassured investors. Revenue and profit figures remained robust, demonstrating the continued demand for Invisalign and other orthodontic solutions. The company's focus on expanding its global reach and introducing innovative products, like Invisalign First, continues to drive growth. However, the path isn't without its bumps. Increased competition from both established players and emerging disruptors is putting pressure on margins and market share.

The orthodontic market is becoming increasingly crowded, with alternative aligner options and traditional braces still holding relevance. While Invisalign retains a significant advantage in terms of aesthetics and convenience, price sensitivity and the availability of more affordable alternatives are factors that Align Technology must address.

Growth Prospects & Strategic Initiatives

Despite the competitive pressures, Align Technology remains optimistic about its long-term growth prospects. The company is actively pursuing several strategic initiatives to bolster its position:

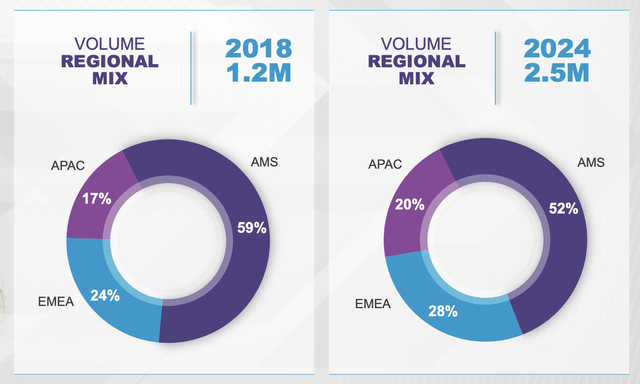

- Expanding into Emerging Markets: Align is targeting regions with rapidly growing middle classes and increasing awareness of orthodontic treatment.

- Direct-to-Consumer (DTC) Initiatives: Exploring DTC channels can bypass traditional orthodontists and potentially increase accessibility for patients.

- Technological Innovation: Continuous investment in R&D is crucial to maintaining a competitive edge and offering advanced features. This includes exploring AI and machine learning to improve treatment planning and aligner design.

- Strengthening Doctor Relationships: Maintaining and expanding its network of Invisalign-certified orthodontists is paramount to continued success.

The Valuation Question: Is ALGN Overpriced?

This is where the debate intensifies. Align Technology's stock currently trades at a premium valuation, reflecting the market's expectations for continued high growth. While the company's strong earnings and market leadership justify a higher multiple, concerns about competition and potential economic slowdowns have led some analysts to question whether the current price is sustainable.

Australian investors need to consider the impact of currency fluctuations and global economic trends on ALGN's performance. A stronger Australian dollar could negatively impact returns, while a global recession could dampen demand for elective procedures like orthodontics.

Investment Recommendation: Proceed with Caution

Align Technology remains a compelling company with a dominant position in a growing market. However, the premium valuation warrants caution. Investors should carefully weigh the company's strengths against the competitive pressures and macroeconomic risks. A 'buy' rating is contingent on the company demonstrating continued innovation and successfully navigating the evolving orthodontic landscape. A 'hold' or even 'sell' rating might be appropriate for investors who believe the current price already reflects a significant portion of the company's future growth potential.

Disclaimer: *This analysis is for informational purposes only and should not be considered financial advice. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.*